An ounce of information

Article by Pnut King

Published on 03/10/2023 in Peanut News

Despite the vast array of peanut species & varieties available, only few have gained dominance in the market. Know how can stakeholders ensure their voices are heard amidst the competition

Ten thousand years ago, an unsuspecting pair of Bolivian bees did something remarkable. They cross-pollinated two wild plant species, and created the peanut as we know it today.

Modern varieties have evolved significantly – most notably by becoming entirely self-pollinating – and have exploded in popularity ever since they were first cultivated by human civilisations. But the true origins of the peanut lie in that happy accident of nature many years ago.

Today, there are thousands of varieties, species, and origins of peanuts, each with their own distinctive physical and chemical characteristics and flavour profile. But across the major producing regions of the world (which, between them, are expected to produce 68 million tons by 2050) it’s fairly common for just one or two species to dominate.

Why is that? What accidents of nature – and effects of international trade – have meant that so many types of peanuts are neglected while others become wildly popular?

In this article we’re going to take a look at some of the marketing, lobbying, and governance strategies used by certain governments and groups to promote particularly desirable peanut varieties, and explore how this has impacted the crops that are planted, harvested, and enjoyed by millions of people around the world.

Major varieties and where you find them

In a globally connected marketplace peanut production and consumption have responded rapidly to growing demand. As a fast-growing crop it’s possible for farmers and manufacturers to adjust their peanut specification and adapt to market conditions.

This has resulted in a particular focus on specific varieties of peanuts which are seen as superior for typical consumer uses, whether snack manufacturing, peanut butter production, or a bird and animal feed specification. Across different regions and marketplaces, certain varieties have come to dominate.

Here are some of the biggest regional crop trends:

Chinese dominance

The Chinese peanut market is one of the biggest in the world, with the country importing an incredible 1,002,599 tons of peanuts in 2021. This figure has snowballed dramatically in recent years, up from 478,834 tons in 2019 and a mere 181,510 tons in 2018. These figures are no small fry: In 2021, China spent a remarkable $1,028,039,000 on its peanut imports.

In addition, China is also a global powerhouse of domestic peanut production. The country produced a world-beating 18,200,000 metric tons in 2021/22, a year-on-year increase of 4%. Equally, in 2020, approximately 17.8 million metric tons of peanuts were consumed in China, an increase from about 16 million metric tons consumed in the previous year.

With such a vast amount of buying power, Chinese consumers really ought to have the freedom to choose from every kind of peanut variety on the market. However, the Virginia variety has become the most popular. Primarily known for having the largest kernels and accounting for most of the peanuts roasted and processed in-shell, Virginia peanuts make excellent snack peanuts, thanks primarily to their size. They’re grown extensively across China, particularly in the Henan, Shandong, and Hebei provinces.

American autonomy

Not so far behind China, the US has emerged as one of the world’s largest peanut markets, with the average American adult estimated to consume 3.5 kilograms of peanuts per year. Around 50% of this consumption is in the form of peanut butter, and with new products gaining traction in the market (such as peanut oil and peanut flour), it’s no surprise that the Runner variety has become the most popular, largely due to its suitability for use in peanut butter and other confectionery.

Last year (as of December 2022), 1,420,971 acres of peanuts were planted in the U.S., more than 80% of which are planted with the Runner variety. These peanuts have mostly uniformly sized kernels, making them ideal for the kind of even roast required for delicious and consistent peanut butter. Once again, we find that growing trends are being led by the dominant consumer demand.

Indian indulgence

Another of the world’s largest peanut producers, the Indian market has a particular taste for the Spanish and Runner varieties.

Spanish or Java peanuts tend to be quite a small variety, with red skins and a strong nutty flavour – partly derived from their slightly higher oil content. They are typically used as roasted spicy or salty snacks, for the extraction of oil, or in cooked meals such as vegetable pulao and curries thanks to their sweet aromatic smell and creamy butter-like taste.

In the spring and pre-summer season, they typically make up 85% of the Indian peanut crop.

European pre-eminence

For similar reasons to the US, the Runner peanut variety is also dominant in the European marketplace. As a developed economic environment, it’s a diverse market, with kernels mainly consumed as roasted or fried salty snacks, or sold to consumers in-shell.

European manufacturers also regularly experiment with different flavours and coatings, and include peanuts in peanut butter, cakes, and chocolate sweets. The market is developing rapidly, with large import volumes of unprocessed nuts coming from developing countries.

What happened to the rest?

Other species of peanut are still traded, used in manufacturing, and consumed, but for a number of reasons have become less popular and less premium than their counterparts discussed above. Valencia peanuts, for example, are still grown in the US, but make up less than 1% of total production.

As market forces move the focus towards a particular variety, it’s no surprise that farmers and producers similarly pivot their planting strategies, leading to a glut of in-demand varieties and the absence of the rest. Over time, this has led to some of the world’s major producing regions becoming almost exclusively specialised in one or two varieties, to the near exclusion of all others.

It’s all in the marketing

Fundamentally then, what drives the success of a particular variety, species, or origin of peanut is something far larger than its internal characteristics. No matter what volume a species of nut is grown in, it’s the local, national, and international legislative context, governance, and commitment to marketing that truly impacts its success.

So for a peanut variety to be widely adopted, it needs to not only have the right chemical makeup, flavour profile, and characteristics that can survive international shipping, but it also needs sufficient governance and marketing to get it to the consumers. It is in this vast geopolitical context that the humble farmer grows their peanuts, battling with local and international forces that aren’t necessarily within their control. It’s for this precise reason that African varieties of peanuts, for example, typically fail to realise the best value accretion.

National peanut marketing strategies: The US example

As a capitalist, marketing-driven economic nation, the US provides a backdrop for some of the most telling examples of a coherent, national peanut strategy. Whilst the American obsession with peanuts is fairly long-standing, there are plenty of forces at work to grow consumption ever further.

The National Peanut Board, in particular, is responsible for promoting consumer marketing that drives awareness of peanuts and their benefits, and has been able to lead heavily on “better-for-you” snack messaging. Peanuts are nutritious, boast heart and health benefits similar to those of more expensive nuts, and are an economically viable crop thanks to a stable production and pricing base – and the National Peanut Board promotes this message far and wide.

With more protein per nut than competitors (7g per serving), and over 30 essential vitamins and minerals contained within them (such as vitamin E, magnesium, folate, copper, and phosphorus), peanuts are being wielded as a powerful weapon in the fight against hunger and famine globally.

Crucially, peanuts also have strong sustainability credentials, speaking to consumers’ growing eagerness to consider environmental impact. To that end, the American Peanut Council Sustainability Initiative created the Peanut Trust Protocol, setting standards for sustainably grown peanuts and giving farmers a platform to showcase their efforts.

Generation Z consumers as well as millennials and those from Generation X typically expect companies to make a positive social impact, and today, nearly half of US consumers are likely to change what they buy depending on the company’s environmental commitment. As a result, a sustainable message is a necessity rather than a luxury.

So why are peanuts so sustainable? With every part of the plant turned into food, animal feed pellets, fuel, or even hay, peanuts are a truly “zero-waste” product. Similarly, peanuts require a fraction of the water needed by other nuts: just 12 litres to grow 28g of peanuts, versus over 108 litres for almonds and almost 98 litres for walnuts.

At the same time, American peanut promoters have been highly effective in tackling the challenges that face increased consumption. Over the past 20 years, the National Peanut Board has invested more than $35 million in food allergy research, education, and outreach. In part thanks to the National Peanut Board’s lobbying efforts, the USDA even introduced guidelines recommending that infants aged 4-6 months have peanuts incorporated into their diet in order to reduce the chances that they develop a potential allergy. These kinds of significant shifts protect the wider industry from future shocks, and build a reliable future for the peanut ecosystem.

How can others compete?

Promoting the consumption of peanuts and the use of a more diverse range of varieties is impossible without funding and a committed political will to elevate the industry.

America’s National Peanut Board and the American Peanut Council are prime examples of empowered, funded, and motivated organisations that are able to make real national change. In 2020, the National Peanut Board even donated 32,000 jars of peanut butter to food banks to help families in need, further moving itself into the centre of public consciousness.

Other developed countries and trading blocs have also followed suit, with their own lobbying groups and sustainability initiatives that help drive demand and grow consumption.

Argentinian producers, for example, supply 55% of the EU’s total consumption, and have moved quickly to reinforce sustainability practices and their compliance with the EU Green Deal and Farm to Fork Strategy. The “Argentina Peanuts project” is committed to developing further improvements in this area. Since 2018 the Argentine Peanut Chamber has conducted its “Maníparamí” (“Peanut for me”) campaign, encouraging domestic consumption by promoting the nutritional benefits and versatility of peanuts.

By highlighting the positives and addressing concerns and challenges faced by consumers, such as allergy risks, established and new market players can shape the future of peanut production. Expertise is key: the ability to make the case for a local variety based on nutritional evidence, health benefits, and sustainability impacts. Real data and positive change can be used to influence policy, build support, and explore new products and uses that grow the power of the humble peanut ever further.

The solution? Connection, communication, and information-sharing

Educated, motivated, and engaged players in the global peanut trade know that value and quality can vary seasonally – and they know better than to follow the herd when it comes to variety selection.

By connecting the dots throughout the peanut value chain, Agrocrops help manufacturers, traders, and farmers alike to better understand the wider ecology, delivering better value and higher quality for everyone.

Marketing is a powerful force, and it has its uses for boosting international trade and supporting targeted peanut consumption, but it’s no substitute for a peanut trade partner that can draw on over 55 years of industry experience, in-depth local seasonal intelligence, full-chain origin tracking, and a mission to share knowledge, insights, and progress with the entire value chain.

For more information or to talk nuts with the peanut people, get in touch.

With over 17 years of experience in the peanut industry and numerous awards recognising his contributions, he founded Agrocrops in 2008, a leading global peanut company. His passion for peanuts drives his commitment to improving the industry for all stakeholders and promoting sustainability.

Published on 30/12/2024 in

Published on 30/12/2024 in

Published on 30/12/2024 in

Published on 26/12/2024 in

.jpg)

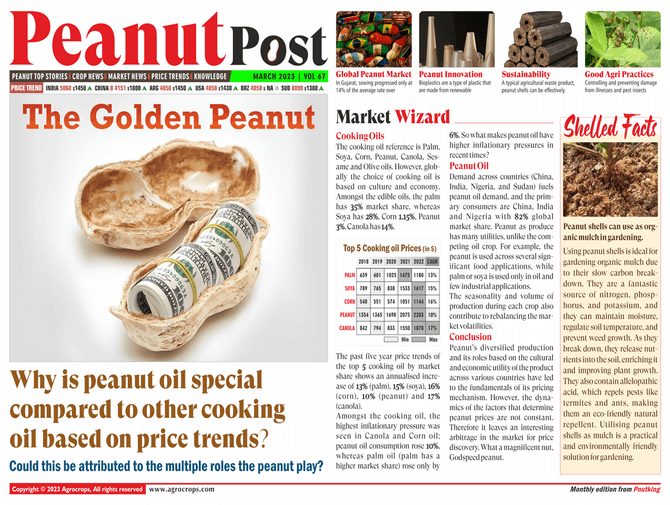

Published on 03/03/2023

Published on 03/03/2023

Published on 02/17/2023

Published on 02/15/2023