How weather and financial calamities affect peanut production and trade? Will China (the big belly) have a lousy cropping year this time?

Global Peanut Market

The new crop season began in India with Spanish peanuts harvested

Peanut Innovation

Silk and wool have always been highly valued in the textile business

Sustainability

Sustainable seed development in peanuts involves practices that

Good Agri Practices

A well planned, crop rotation system can ensure good yields of high quality

Market Wizard

Gone are the days when profits were made with information asymmetry; we are in a flat world now.

How do the peanut prices perform in an El Nino year? Does the production gets affected? Will China continue to import with a 15 yearhigh Yuan?

El Nino Peanut Crops

The El Nino effect does not directly impact the peanut regions in the Asian and African continents; this is because of the growing season patterns, geo-location, and the seed type used, typically 90-120 day crop varieties (in the Asian & African regions). Other origins don't seem to have a production impact either.

The El Nino effect does not directly impact the peanut regions in the Asian and African continents; this is because of the growing season patterns, geo-location, and the seed type used, typically 90-120 day crop varieties (in the Asian & African regions). Other origins don't seem to have a production impact either.

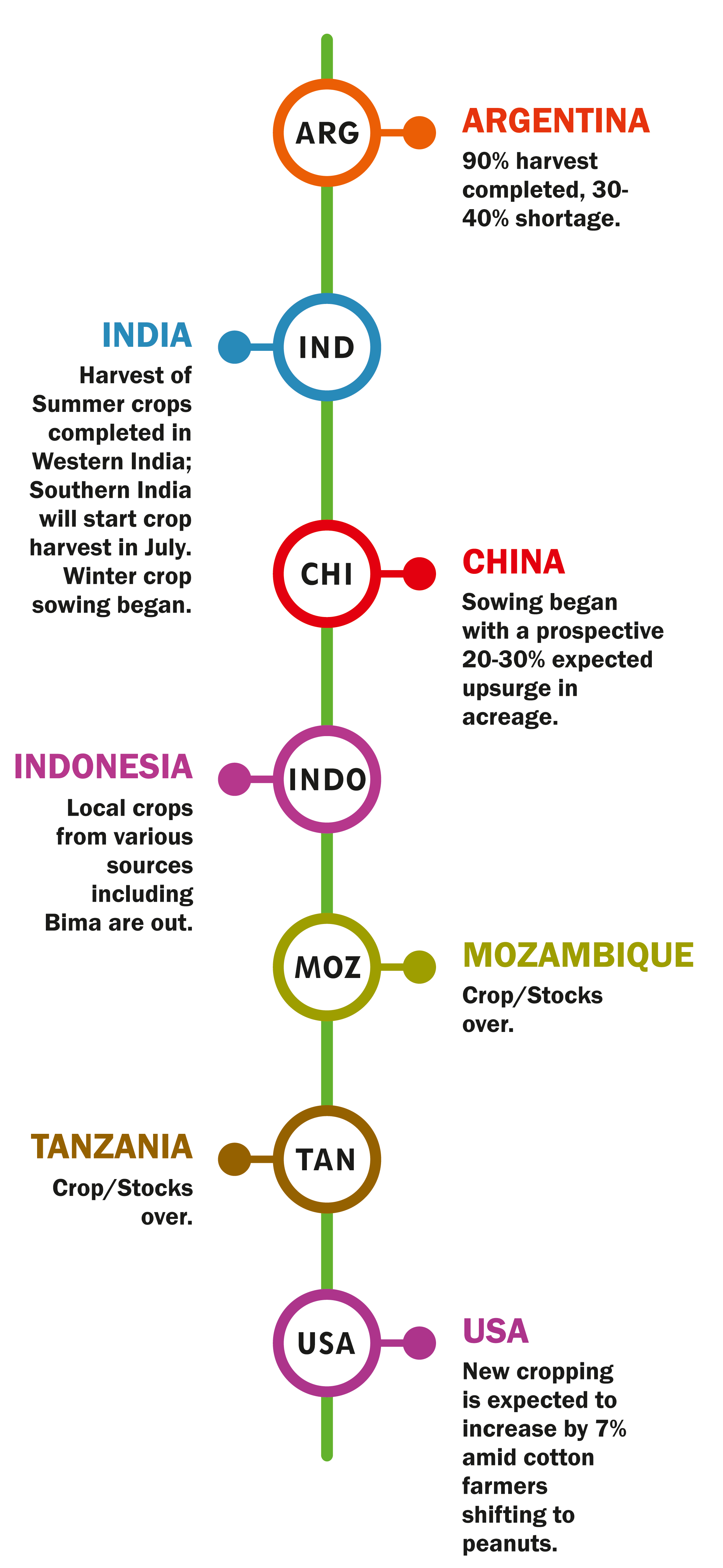

El Nino years and peanut production (in '1000 Tons) across origins:

Based on data analysis, the quality certainly does get influenced by weather calamities, but not the quantity in absolute terms. Often the

peanut crops are affected by sudden storms, frost or a prolonged period of dryness than a cyclical weather calamity.

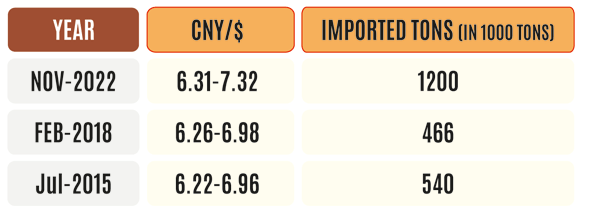

CNY

The Chinese Yuan plays a crucial role (almost like the US$) in the

Asian foreign exchange markets. When the CNY gets weaker, it weakens a basket of currencies such as the Indian Rupees, Indonesian Rupiah, Thai Baht and the Philippine Peso. The Chinese Yuan has made significant moves in recent years, and their respective import volumes (in 1000 Tons) below:

The forex fluctuations or El Nino do not directly influence demand and production. However, the rise in CNY does trigger a weakening in INR, resulting in a lower cost of exported peanuts, resulting in a rise in trade volumes.

The Chinese Yuan plays a crucial role (almost like the US$) in the

Asian foreign exchange markets. When the CNY gets weaker, it weakens a basket of currencies such as the Indian Rupees, Indonesian Rupiah, Thai Baht and the Philippine Peso. The Chinese Yuan has made significant moves in recent years, and their respective import volumes (in 1000 Tons) below:

The forex fluctuations or El Nino do not directly influence demand and production. However, the rise in CNY does trigger a weakening in INR, resulting in a lower cost of exported peanuts, resulting in a rise in trade volumes.

In the peanut industry, demand is always the king, it is irrespective of economic and natural influences, this is why we say peanut industry is “evergreen”. Peanut is a unique product where each product is an industry in itself, therefore the peanut economy is does not thrive based on success or failure of one trend, instead it is influenced by several trends of these verticals (oil, butter, snacks, trading, biomass). Irrespective of weather or financial challenges, peanut demand is here to stay and keep marching towards the 68 million tons annual production. Godspeed peanuts.

Peanut shell vinegar is an alternative to ordinary vinegar.

Peanut shell vinegar is made by fermenting peanut shells, resulting in a tangy vinegar with a unique flavour. It retains some of the nutrients present in the peanut shells. Peanut shell vinegar's tangy and nutty flavour makes it a versatile ingredient in vari ous recipes. It pairs well with salads, stir fries, roasted vege tables, and marinades for meats or tofu. It can also be used as a finishing touch for soups or drizzled over grilled dishes for an added tangy flavour.

Global Peanut Market

With favourable weather condi tions, Gujarat winter sowing began in the last week of June, and 49% of sowing was comp leted. The majority of the sowing is G20 and BT32 varieties. The Kutch district is also performing well. Rains are forecasted thro ugh July 2nd. It is too early to ascertain the acreage, although the expectation is to exceed the previous year. Summer crop arri vals in north Gujarat are rising in volumes along with rain damaged and higher moisture raw material. The majority of the farm stock is with stockists for sowing or trad ing purposes. Rajasthan sowing is nearly over, with a 115% crop expe cted this year.

The South Indian arrivals are closed with few leftover stocks. Some parts of the origin have an upcoming harvest with good quality from AP and TN; however, these are small intercrops. Crops from Karnataka are facing on going issues due to insufficient rain. However, the next harvest is expected to be bountiful.

Currently, the market is flushed with Spanish-type peanuts from UP, which are not average + quality. With the present stock hold and expected supplies until the Winter harvest, Indian con sumers and manufacturers could face an acute shortage of raw

materials.

The market is quiet, and a drop in consumption may occur in the following days. In contrast to recent years, the carry-forward stock is expected to exceed 1 million tons. Consumption is expected to fall by 2%, while exports could fall by 3%. Input and farming costs are skyrock eting, with estimates ranging from 15–25% depending on the location of peanut fields. As a result, agricultural represen tatives are asking for a higher price for the 2023 crop.

The crop area is expected to expand by 7% compared to 2022, but the trend could be seen as encouraging going forward, although experts predicted a 12–15%growth in acreage. Mexico and Canada remained the leading contributor s to US peanut exports.

Nearly 90% of the harvest is completed with 30-40% of crop damages and yield loss. What's good is good. The 2022 crop stock is almost depleted. The good news is that the demand for Argentina peanuts in the Eu is stable. Land lease prices rise (5% to 15%), which may result in higher peanut prices or lower acreage during the next crop. Argentina's peanut organisation is still predicting a final output of 6,87,236 metric tonnes by the end of the year. Once the harvest is complete, this value may change. Raw peanut costs have risen to $1900+, which is not a good sign for European clients. Furthermore, most ship pers sell peanuts in the short term rather than the long term. Argent inean peanuts are not preferred except for the EUamid the current price levels; therefore, the prices should be corrected logically

A dramatic price rise was seen in recent months; the sentiment rose more than the actual price. However, the Brazilian Real/$ strengthened (roughly 5%), making exports uncompetitive. Farmers released cargo in small lots amid bullish trends in the non-EU market. In recent years, the oil trade has aided the proce ssors in achieving the highest average earnings and profits from raw peanut exports. Comparaed to Argentina, Brazil's peanut prices are lower at $1600 for 38/42, and Importers from Russia and non-EU countries are preparing to meet peak demand between September and November. Crude peanut oil prices have been constant for almost a month,between $1700 & $1800. We expect Brazil's peanut prices to soften in July.

The market moved from bad to worse. Several oil crushers shut shop amid bad weather and market condition. Several thou sand Sudanese peanuts (shipped on a consignment basis) are left at the port and warehouse with no takers. Economic conditions are worse than the peanut market, several NPA reported in the pea nut industry with banks auction ing them. The Chinese market is setting itself for consolidation. Few big crushers are seen with 200-300 million Yuan losses this year. Sowing began in several origins with a 20-30% rise in acreage; local stocks are more than enough for this market condition. Long shape peanuts continue to be strong, while the round shaped peanuts of Chinese and other origins drop like a stone. Continued downside and lack lustre trends are expected in July.

Sudan

The capital city remains closed, and exporters relocated their cargo to Port Sudan. Some exporters offer peanuts in $1400–$1450 range FOB Port Sudan. Amid the war, the peanut movement from Khartoum to Port Sudan is dangerous and expen sive.

Tanzania

Unexpected rains wreaked havoc during harvesting, resulting in fewer crops arriving. As a result, the cargo's quality has suffered, and many exporters refused to ship. The trade occurred between $1100 and $1120 CIF Indonesia for lower-quality specs.

Mozambique

Exporters have acquired over 75%of the supply, with only a small quantity left with farmers. Farmer stock in the local market is trading between 58-60 metical per kg. This season will be short and end abruptly.

Editor’s Pick

Mr.Chen Xi Bing

Qingdao fushuai

Say about you

I've been in the peanut industry for about 20 years and own an oil crush facility.

Which country do you foresee will be a leading net supplier of the peanut produce after 10 years?

I've travelled to the United States, and I believe their peanut supply is the greatest in the world. The machinery they use to plough, seed, and harvest is truly cutting-edge. I don't think it matters too much who will be the world's largest supplier in the next ten years. However, every major peanut-producing country should strive to adhere to current peanut-growing standards.

Cultivar Highlights

For sustainable farming, the Trombay ground nut variety TG 38 serving as a game changer.

Residual moisture farming is an agricultural practice that involves utilizing the remaining moisture in the soil after the rainy season. As TG 38 is suitable for residual moisture farming, it requires less additional irrigation, reducing overall water consumption compared to other peanut varieties that may rely more heavily on irrigation. Which is crucial for long-term sustainability, especially in areas facing water scarcity or droughts. By reducing the need for additional irrigation, TG 38 may minimize the strain on water sources and associated environmental

...TG 38 may minimize the strain on water sources and associated...

impacts such as groundwater depletion or increased energy consumption for pumping water. TG 38 has an erect growth habit with sequential branching, semidwarf height and medium-sized dark green leaflets. It has a compact pod setting with a smooth pod surface. Seeds are more spheroidal with rose colour. The seed contains 48.0% oil, 22.6% protein, 20.4% carbo hydrate, 5.0% sucrose, 2.7% crude fiber and 2.2% ash. TG 38 oil contains 39.6% oleic acid, 39.6% linoleic and 12.1%palmitic acid.

Source:DM Kale, GSS Murty and AM Badigannavar* 2007, Nuclear Agriculture and Biotechnology Division, Bhabha Atomic Research Centre, Trombay, Mumbai 400 085, India.

Peanut Innovation

Utilizing the protein source in peanut meal for making fibers for textile industry

Silk and wool have always been highly valued in the textile business due to their desirable properties. These fibers are composed of protein molecules arranged in long threads, making them suitable for fiber synthesis. Although any protein-containing substance can be used to extract protein for fiber production, groundnuts, which are commonly grown in hot and humid areas, are a promising source of vegetable protein. Peanut-derived arachins and ardil are very important. Arachis oil is mostly derived from groundnuts, resulting in a high-protein meal. The protein is separated from peanut meal by some methods like extraction, dissolving in spinning solution of aqueous urea, ammonia, caustic soda and detergents. After maturation, the solution, which has increased viscosity, is extruded through spinnerets into an acidcoagulating bath. The resulting filament, initially weak and flabby when wet but brittle when dry, undergoes treatment with formaldehyde, drying, and cutting into staple fibers. Although structurally similar to wool, groundnut protein fibers lack rough, scaly surface and felting properties. They offer a soft, wool-like handle and are oftenblended with other fibers like wool, polyester, cotton, and viscose to achieve desired characteristics at a lower cost.

Current Crops

Peanut Sustainability

Peanut cultivation ensures longterm seed development.

Sustainable seed development in peanuts involves practices that ensure the availability of high-quality, genetically diverse, and locally adapted seeds while considering environmental, social, and economic aspects. The key principles for sustainable seed development in peanuts are conservation and use of genetic diversity Preserve and utilize the genetic diversity present in peanut germplasm to develop improved varieties that are resilient to biotic and abiotic stresses. Maintain seed banks or reposit ories to safeguard diverse peanut varieties for future use. Particip atory plant breeding Involve farmers, local communities, and other stakeholders in the breeding process. Participatory approaches increase the adoption of new varieties and promote farmer empower ment. Climate resilience Develop peanut varieties that are adapted to local climatic conditions and have enhanced resilience to climate change impacts, such as drought, heat, and disease outbreaks. Breeding for traits like drought tolerance disease resistance, and early maturity can contribute to climate resilience. Disease and pest resistance Incorporate genetic resistance to major diseases and pests affecting peanuts, such as fungal pathogens and insect pests. This reduces the reliance on chemical inputs, promotes sustainable pest management, and enhances yield stability. Nutritional quality Consider the nutritional aspects of peanuts, such as oil content, protein quality, and micronutrient composition, in breeding efforts. Develop varieties that have improved nutritional attributes to address nutritional deficiencies and promote healthier diets. Farmer-led seed systems Promote farmer-led seed systems where farmers have access to locally produced, high-quality seeds. Facilitate farmer-to-farmer seed exchange networks and community-based seed enterprises to ensure seed availability, affordability, and adaptability. Quality seed production Establish quality seed production systems that adhere to recognized standards and protocols. Encourage the use of certified seeds that meet specific quality criteria, including purity, germination rates, and freedom from diseases and contaminants. Knowledge sharing and capacity building Strengthen the capacity of farmers, breed ers, and extension services through training programs, workshops, and knowledge sharing platforms. Enhance the understanding of sustainable seed development practices and provide techni cal support to farmers for seed production, s torage, and handling. Policy support Government s and policy makers should develop and implement supportive policies that prioritize sustainable seed development in peanuts. By integrating these principles into peanut seed development programs, stakeholders can contribute to the longterm sustainability of peanut cultivation, enhance farmers livelihoods, and promote the resilience of peanut production systems.

...varieties that have improved nutritional attributes to address nutritional ...

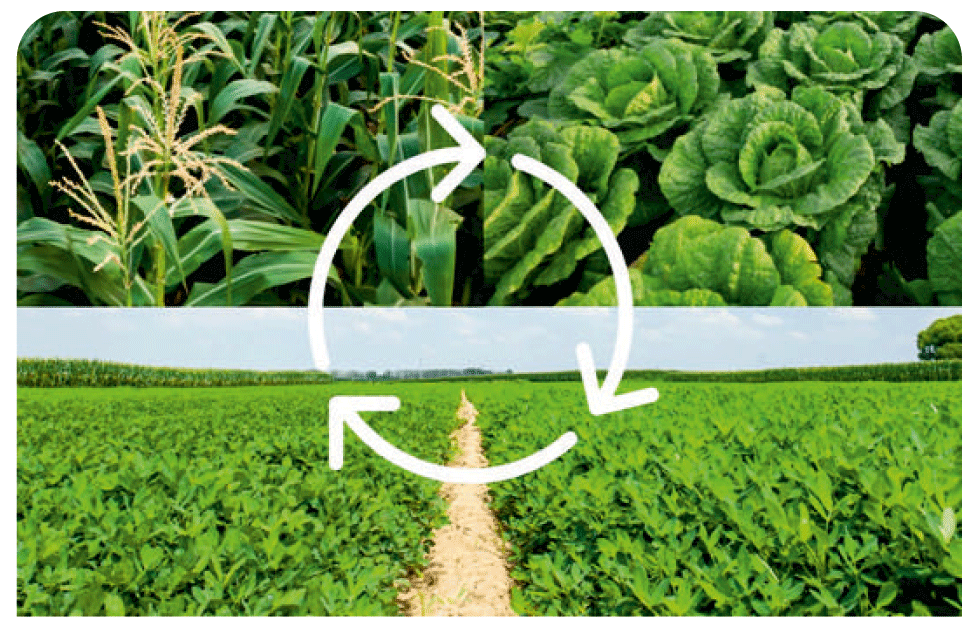

Good Agricultural Practices

Crop Rotation System for Good Agricultural Practises in Peanut Cultivation

A well planned, crop rotation system can ensure good yields of high quality. In order to reduce risk in the farming system, groundnuts should be cultivated in rotation with other crops, especially grass type crops. When selecting crop rotation, the long term viability of crop rotation to reduce weeds, insect and disease pressure, as well as its economic viab ility must be considered. Groundnuts have been shown to improve the yield of subsequent maize and other grain crops up to 20%. One of the best crop rotation systems is one in which a grass fallow is followed by groundnuts. Usually groundnuts also produce a better crop on fields that have been fallowed. Circumst ances may force a farmer to plant groundnuts in succes sion in which case disease problems can be expected, especially leaf and pod diseases. This can be improved by deep Ploughing which may reduce the disease problem. Generally, as a rainfed crop, groundnut is grown year after year in a mono cropping system. This practice may lead to crop failure due to adverse weather conditions during the crop growth period. The ground nut in general should be rotated with cereals like maize, wheat, sorghum, pearl millet or minor millets. It was also found that groundnut does well after wheat, maize, sorghum, pearl millet and tobacco. Groundnuts should not follow cotton or soybeans due to the risk of diseases. Ground nuts following tobacco also have a risk of diseases. A well planned which can be altered when necessary should always be followed. Other wise, the desired crop sequence may be interrupted and the maximum benefits of the rotational effect will not be obtained.